Improve cash flow and grow your business with Autobooks1.

Spend less time on invoicing and the headaches involved with tracking down past-due payments. Autobooks gives you more time to work on cash flow efficiencies and growing your business.

If you have First Bank Digital Banking, you already have access to Autobooks. Simply navigate to the Autobooks widget in your dashboard to get started.

Manage invoices

- Create and send digital invoices to your customers

- Customize a professional-looking invoice with your business logo and brand

- Schedule recurring invoices and automate past due reminders

Improve payments

- Get paid faster, right to your First Bank checking account

- Accept credit/debit card and ACH payments

- Enjoy low processing rates

Maximize efficiencies

- Run your business from your First Bank Mobile & Online Banking

- Manage your customers and vendors in one place

- Increase your business' productivity

Collecting monetary donations for your nonprofit is easy with Autobooks, too.

Donors give more when it's easy to donate! Here are a few reasons why your nonprofit will love accepting donations with Autobooks:

- Collect monetary donations and payments easily, in-app or online or by invoice

- Have the option to share a simple link or QR code to an online payment form

- Get paid directly into your First Bank checking account in two business days

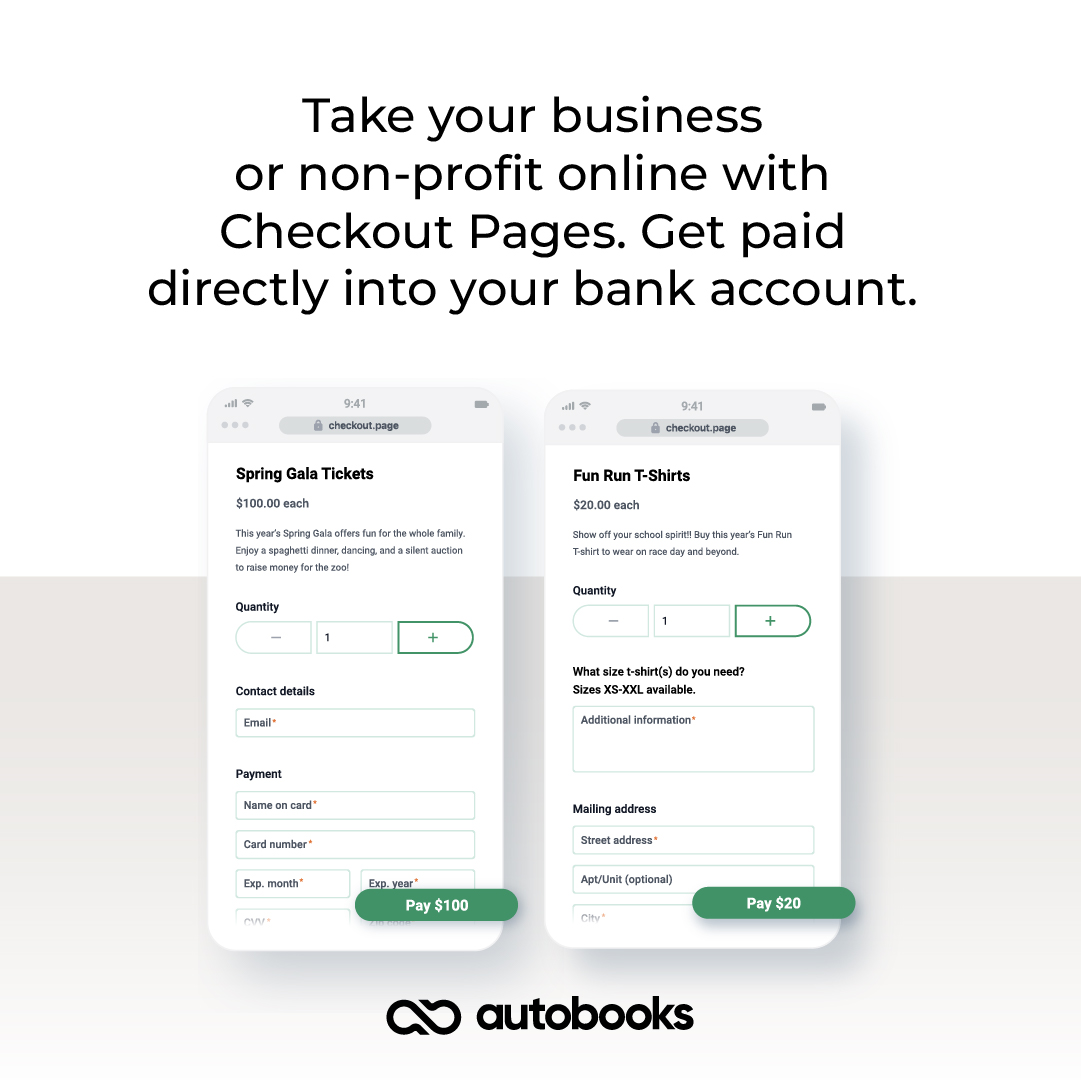

New: Say hello to Checkout Pages!

Now, your business or non-profit can launch an e-commerce site with just a few clicks. And, the payments collected are deposited directly into your First Bank account. Create a Checkout Page today in minutes within your First Bank Mobile App or Online Banking, allowing you to spend time growing your business, instead of managing complicated third party integrations.

Check out these "How to:" videos to learn more

Autobooks FAQs

What is Autobooks and who is it for?

Autobooks is a payments and accounting product suite designed for small and micro-businesses available with First Bank Mobile and Online Banking. The solution bundles essential back-office tools into a single, easy to use interface that includes invoicing, payments and accounting.

Autobooks is intended for business clients age 18 years and older who have a checking account and use First Bank Mobile and Online Banking.

The following types of businesses make a great fit for Autobooks:

- Any business that sends invoices for its product or service or needs an accounting and cash flow management platform.

- Service-based businesses such as landscapers, plumbers, electricians, consultants and others.

- Entrepreneurs or individuals with side hustle-type jobs such as babysitting, freelancing, tutoring, photography, etc.

- Nonprofit organizations seeking to collect donations online.

What are the benefits of using Autobooks?

Autobooks is a complete set of financial tools that can be accessed within First Bank Mobile and Online Banking allowing businesses to manage their accounts and billing all in one place.

With Autobooks you can:

- Create professional electronic and physical invoices in seconds.

- Accept payments by credit card, debit card and ACH transfer.

- Track customer payments and accounts receivable.

- Generate reports like balance sheets, income statements and customer aging reports with the click of a button.

Is Autobooks safe?

Yes! Autobooks exceeds industry standard security recommendations to protect your business and financial information.

business/autobooks

1A First Bank checking account and online banking are required. No monthly fee to send invoices and accept payments. Payments collected through Autobooks are subject to a processing fee. The services are provided by Autobooks and are subject to customer’s agreement to Autobooks’ terms of use. First Bank may receive revenue from Autobooks.